BLOG POST

5 foolproof tips to create an invoice that performs

As a small business owner, you know how expensive it can be to wait for customers to pay their bills. In fact, poor cash flow is the leading reason most businesses fail. If you are struggling to keep enough cash on hand to run your company, here are five tips that will help you create an invoice that is read and responded to right away.

Create clear invoices

When your clients have all available information available at first glance, they’re more likely to take immediate action. This is an absolute truth for any business-to-business transaction where reviews and approvals are required to issue payment.

If you have clients that you regularly send invoices to or have invoices that are grouped under a single project, include an account summary section. This gives everyone an at-a-glance status of all of their invoices and helps avoid any questions or confusion about what this invoice is for. If there is an outstanding balance, it will be easy for the client to see and pay. Clarity expedites payments.

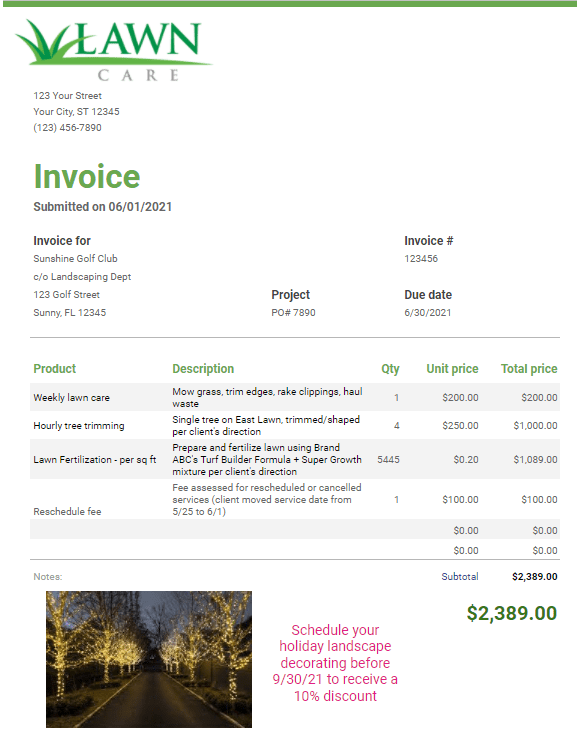

Create invoices with line items broken out

Every time you create an invoice, you need to include the standard information everyone expects: date, product, etc. But the more detailed and defined each item is, the less delay you can expect. This is why we recommend you break out each line item. It lets you explain each item in full, which is especially helpful when the description might not be easily understood by someone unfamiliar with the project.

For example, say your client needs to route their invoices to an accounts payable department. They may need to categorize each expense and list which department it belongs to. Then they’ll need to define the category for their internal tracking (ex: office supplies, hardware, or services). If your invoice already includes that information, you save them time and help get your invoice processed quicker.

Even with clients that typically pay straightaway, spelling everything out eases the process and reduces questions. This is particularly helpful with larger projects, where there may be an element of “sticker shock,” even when the bill follows the contract precisely. Creating an invoice with well-defined items sidesteps this problem. It not only prevents price confusion. It builds trust by creating transparency.

Remember, an invoice is more than a bill. It’s a form of communication. When you create an invoice that describes and categorizes every product in full, it tells the client exactly what value you’ve added to their business.

Don’t create an invoice with empty space

Invoices aren’t necessarily the easiest place to launch a new marketing campaign. However, they can be a great way to promote discounts, fees, and services.

These may include:

- A discount for early payment

- Discounts for certain payment methods (ex: $5 off any invoice paid by credit card)

- Discounts for early scheduling (ex: confirm your appointment before December 31 and receive 5% off all services)

- Penalty fees for late-payments

- Special rate for long-term contracts (ex: lower monthly rate)

- Supplemental services (ex: holiday light installation/tear down, seasonal decor rental)

- Specialty services (ex: drought-resistant garden planning, butterfly garden maintenance)

- Tips and advice (ex: gather your documents year-round and post to our digital archive to be review-ready anytime)

Let clients know you accept multiple payment methods

When you create an invoice, be sure you list the payment options you accept. The more you offer, the faster the client’s likely to pay.

Businesses often prefer to issue payments just before their deadline (i.e., pay on day 89 of a 90-day term). But they also want that payment to appear on their ledger immediately. So even businesses that rely on checks may agree to ACH transfers to keep their books accurate as possible.

However, for a variety of reasons, companies increasingly prefer to pay with credit cards. Consequently, adding the ability to pay electronically not only expedites payments but also makes clients happy.

To help customers finalize payment the first time they view an invoice, consider storing multiple payment types. Keeping multiple credit cards or ACH accounts on file saves time. Instead of finding their card and manually entering their details, they can complete their purchase with a click.

Recent Posts

Categories

- accounting (6)

- accounting automation (40)

- Business (30)

- business coupons (1)

- business discounts (3)

- Certification (1)

- competitors (1)

- Compliance (2)

- CPA (6)

- Credit Cards (6)

- customer billing (2)

- Entrepreneur (13)

- Integrations (19)

- ISO (15)

- ISV (14)

- Marketing (8)

- Merchant Processing (19)

- Partners (13)

- Press Releases (4)