A credit card surcharge fee is an extra fee that is added to a customer's total when paying using an authorized credit card.

What is a credit card surcharge?

A surcharge is an extra fee that will be added to the price of a purchase when payment is made using a credit card instead of cash. It's usually a percentage of the overall purchase cost and can range from 1% to 3%. The surcharge should be a percentage of the total and not a fixed amount.

What is the purpose of a surcharge?

The major card issuers (Visa, MasterCard, etc.) allow merchants to charge a small fee to offset the expense of their credit card processing.

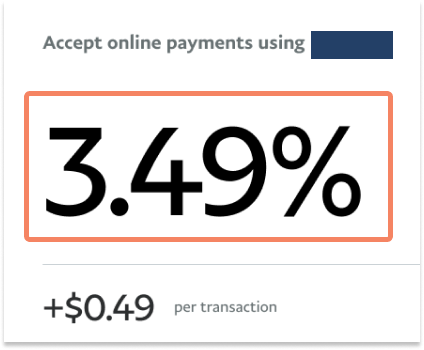

Example: a merchant might pay their processor 3.49% per transaction. They are permitted to pass part of this fee to their customers via a surcharge that is only applied to eligible credit cards.

How do I become authorized to collect a surcharge?

Every card brand has its own requirements for disclosure. Generally, these require that you disclose your intention to collect a surcharge to your processor as well as the card brand with a 30-day notice.

Visa Surcharge Disclosure Form ↗️

What am I allowed to charge?

Approved businesses are allowed to add a surcharge that does not exceed 3% of the total transaction amount. A surcharge can only be collected by an approved credit card type. Debit cards, prepaid cards, gift cards, ACH/eCheck, and other types of cards should not be processed with a surcharge. Local, state, and federal laws may apply to your business that provides additional guidance or restrictions about surcharging. Please refer to your legal department, attorney, or accountant.

How is this different from other fees or discounts?

Your business may add fees or discounts to your services as you see fit. Generally, those fees do not fall under the scope of Surcharge Fees. For example, a restocking fee or delivery fee is not a fee that is assessed to offset your credit card processing fees. This is similar to discounts; a discount is a cost-savings that is offered to customers to promote your business. Discounts for early payments or using cash do not count as Surcharge Fees, as they do not offset your credit card processing fees.

How can I be sure that I don't charge the wrong type of card?

Chargezoom is built to be Visa compliant, which means that we follow the industry-leading guidance to develop our Surcharging feature. Chargezoom will process a real-time lookup on every card as it is entered to confirm eligibility; if the card does not meet the eligibility requirements the surcharge is removed.

How can Chargezoom help me stay compliant?

Chargezoom supports your compliance efforts by following the Visa guidelines to ensure that you only charge approved card types. We also support your accounting department's GAAP compliance efforts by helping you properly categorize your Surcharge Fees. Read more here.