BLOG POST

5 tips to get your invoices paid faster

Over one-third of invoices are paid late. What can you do to speed up payments and make sure your customers don’t fall behind?

Review your invoice template

Invoice templates that have too much — or not enough — information will inevitably lead to slower payment. If a customer has to review what they received and dig through email chains or notes to figure out what it is they’re being billed for, it’s going to cause a serious delay. Many organizations also require detailed invoices for transparency and ease of reconciliation for their accounting departments. View our post about how to create an invoice that performs. It will provide you with best practice tips from industry experts.

Request prepayment or a deposit

Depending on the needs of your business, this may be a small, “good faith” deposit to ensure that the client takes delivery of the service that you’re providing or in some cases, your business may require up-front payment for costs associated with the project. The amount requested should be sufficient to ensure that you can begin with all of the necessary materials.

Additionally, a prepayment or deposit is a motivator for a client to pay their balance on time. Since they have already invested in the project, they are more encouraged to maintain a harmonious business relationship.

Send your invoices online to get paid faster

In addition to the cost savings on printing and postage, the majority of business customers (and their accounting departments) prefer digital records. Sending an invoice via email will ensure that you’re making it as easy as possible for your client to issue payment. If your customer base uses digital payments, you can potentially have all of your funds deposited to your account within hours instead of the days or weeks it might take with mailed invoices.

Offer multiple online payment options

The key to successfully expediting payments with online or email invoices is the ability to accept online payments. Having multiple payment options increases the chance your customers will pay faster. Whether you want to offer payment via familiar services like PayPal, ApplePay, etc., or alternate digital payment methods like ACH, making it easier for the client ultimately results in more timely payments. See our post detailing the different payment options that you may want to consider and how each benefits your business.

Offer discounts for invoices paid early & in full

Although not all businesses can afford to have ongoing discounts for every client, it may be wise to reward those who you want to retain long-term. Whether you offer a one-time discount or a recurring discount is an option worth considering when you’re looking to expedite your cash flow and increase payment volume. See our post about using discounts and penalties to retain clients and expedite payments.

Apply penalty fees to invoices paid late

The terms & conditions of your contracts should always include robust information about payment timings, including whether a discount or penalty may be applied. This not only protects your business against shortfalls due to canceled contracts but can also work as an incentive for clients to pay on time. Many businesses choose to pay at the absolute end of the grace period to retain funds as long as possible but unfortunately due to human error or oversight, this can cause a missed or late payment. Adding penalties, including late fees, can ensure that paying beyond the due date does not become a habit. See our post about using discounts and penalties to retain clients and expedite payments.

Be polite to maintain good relations

It may seem like common sense, but being kind never hurts your business. Often the fear of ridicule or embarrassment can stop invoices from getting paid faster. If your penalty structure is a flat one-time assessment, it may discourage clients from paying in full. If a client knows that the penalty will be the same whether they are 1 day or 90 days late, there is little motivation to act sooner. Being polite can go a long way. Empathize with those who may be only a little overdue and extend the same kindness that you would like to receive. By not assuming the worst about your clients, you can stay on good terms and strengthen your relationship. We have a guide posted here on how to approach overdue invoices with gentleness.

Invest in invoicing software

Invoicing software keeps your business running smoothly without the time and expense of manually reconciling details and following up with overdue clients. You will want to find software that can automate your accounting processes and offer online payments. Automatic invoicing, payment reminders, and reconciliation free you from manual tasks, so you can focus on your business.

Best practices for automation:

- Verify credit card expiration dates and alert clients in advance to reduce payment delays

- Send digital invoices via email

- Send emails that are consistent with your brand, including a ‘send from’ email address that your clients associate with your business

- Accept payment for invoices online – whether sent by email or not

- Diversify your payment options

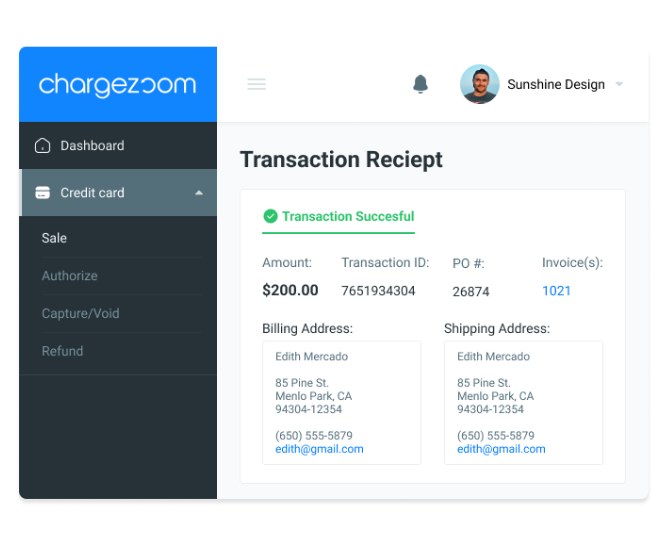

- Automate immediate receipts to clients

- Automate invoice reconciliation

Chargezoom offers a robust platform for small businesses that can help you grow and expand your business without dedicating more time or staff to accounts payable. Automate your processes so that you can scale or pivot your business with ease.

Signup is simple and connects in less than 3 minutes or if you prefer, our staff is happy to walk you through a personalized demonstration.

Recent Posts

Categories

- accounting (6)

- accounting automation (40)

- Business (30)

- business coupons (1)

- business discounts (3)

- Certification (1)

- competitors (1)

- Compliance (2)

- CPA (6)

- Credit Cards (6)

- customer billing (2)

- Entrepreneur (13)

- Integrations (19)

- ISO (15)

- ISV (14)

- Marketing (8)

- Merchant Processing (19)

- Partners (13)

- Press Releases (4)