What is PCI DSS compliance?

PCI DSS (Payment Card Industry Data Security Standard) is a worldwide standard for the secure handling of payment card data, first crafted by the major payment card brands in order to help prevent payment card fraud and protect cardholder data. Compliance is achieved after businesses verifiably fulfill all PCI DSS requirements, which is mandatory for all entities that handle consumer payment data.

Who does PCI DSS apply to?

PCI DSS requirements apply to any and all businesses that collect, store, or transmit payment card data. This includes merchants, marketplaces, E-Commerce businesses and even software solution providers who come in contact with sensitive payment data. Additionally, the level of PCI Compliance needed depends on how many transactions are processed per year; or may be a prerequisite for partnering with certain technical or financial institutions who’ve adopted a security-first mindset.

How much does PCI compliance cost?

The cost of achieving and maintaining PCI Compliance can vary significantly from business to business due to a number of considerations, including how much PCI data they are processing and what resources the organization already has on hand.

For companies who prefer to build their own compliance solutions, costs can range from tens to hundreds of thousands of dollars to build with annual maintenance costs that are in roughly the same range. Auditing and review costs are also significant to maintain certification and must be conducted in regular intervals.

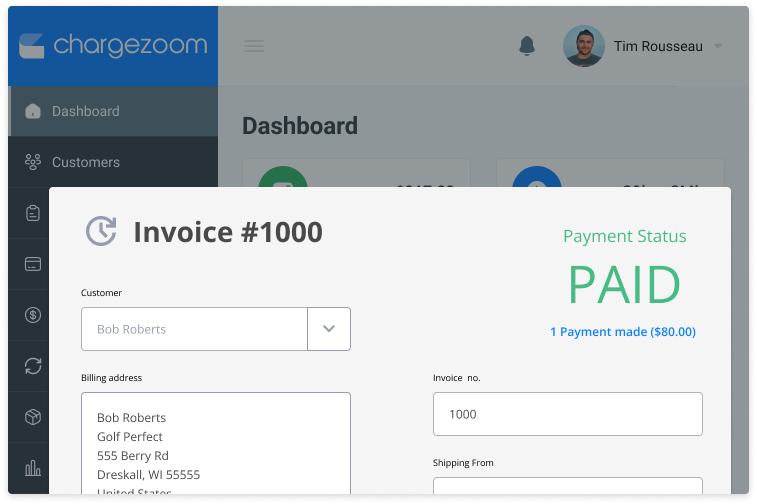

However, Chargezoom users save significantly on their compliance costs as the Chargezoom solution is already PCI DSS certified and compliant. This removes the need for companies to build and maintain their own data vaults, saving tens of thousands of dollars annually.

What is payment tokenization?

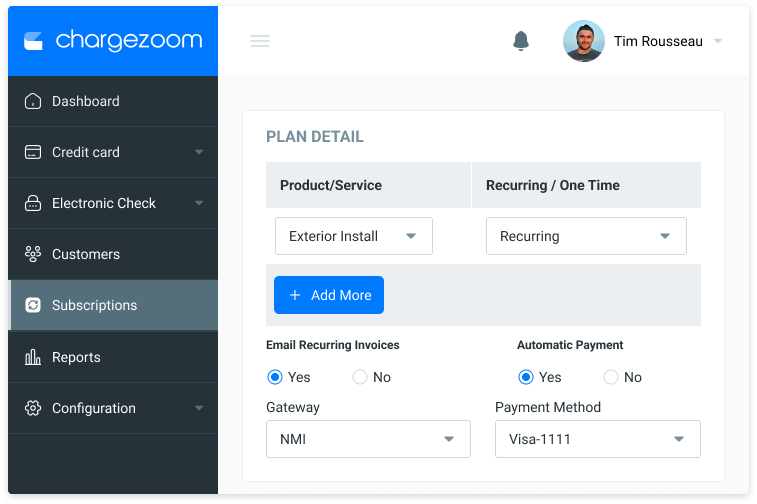

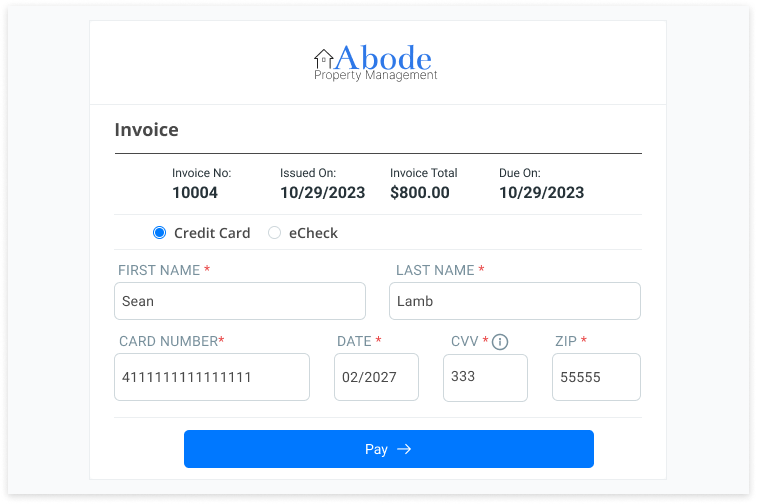

Payment tokenization is a solution that protects payment data entered into any system by encrypting the details and replacing it with a token value. Chargezom provides tokenization of every payment type that is managed by our system, including credit cards, debit cards, and ACH/eCheck details.

What is the tokenization framework for PCI compliance?

Tokenized payment data solutions are used to achieve PCI DSS compliance. By having all of your payment data tokenized, you can meet the criteria for compliance much faster and with less work. Tokenization is a valuable part of your information security measures and with Chargezoom you do not need to build your own tokenization program or vault, all of your payment data is securely stored.

Buy, don't build

Remove overhead

Save $50,000+ every year on infrastructure and security costs

Offload risk and burden

Be ready for audit with payment tokenization that meets PCI DSS requirements

Avoid "lock in"

Payments stored in a gateway vault locked in to a single provider. Using a stand-alone vault solution allows you to change providers any time with no data migration.

Ready to scale with you

Don’t let compliance requirements hold back your expansion plans. Your payments maintain compliance with no additional costs, regardless of processing volumes.

Approved Scanning Vendor (ASV)

PCI ASV refers to requirement 11.2.2 of the Payment Card Industry (PCI) Data Security Standard (DSS) Requirements and Security Assessment Procedures that requires quarterly external vulnerability scans, which must be performed by an Approved Scanning Vendor (ASV).

Chargezoom PCI Compliance scans are performed daily by Sectigo, an Approved Scanning Vendor (ASV). Their insight makes it possible for us to create a safe digital environment for your transactions.

Need full PCI Compliance documentation? Email us at support@chargezoom.com

Launch and scale faster

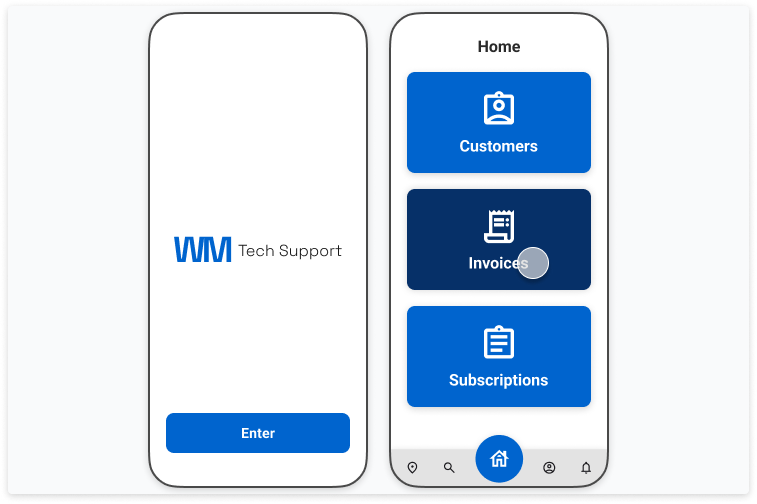

Maintain a flexible financial stack while you build your marketplace. Define your billing and invoicing strategy without diverting development resources.

More time to manage your business

Automation allows you to multitask without compromising your focus. Save 10+ hours every week in manual data entry tasks.

Expedite receivables, accelerate cash flow

Shorten payment cycles without spending hours to chase payments.

Make the apps you love even better

Enhance the service apps that you already use to now include billing and payments.

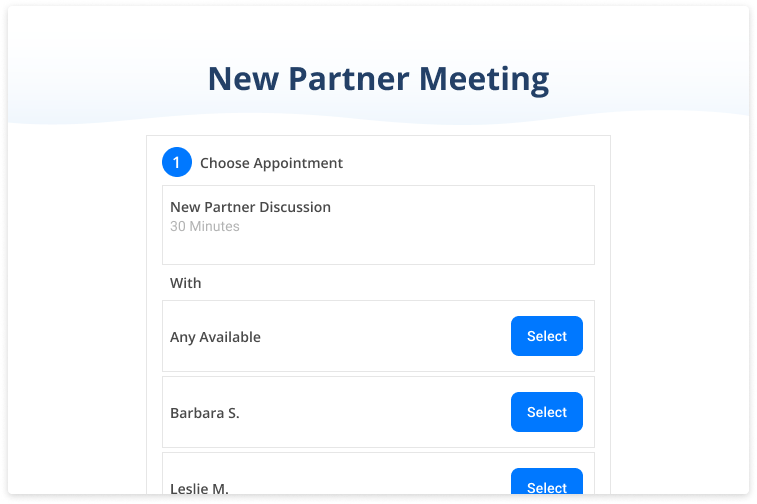

Earn more through referrals

Partner with Chargezoom to deliver cutting-edge technology to your clients, peers, and merchants.